Indicators on Home Loan Calculator You Need To Know

Table of ContentsRefinance Home Loan Things To Know Before You Get ThisNot known Details About Clark Finance Group Home Loan Lender Unknown Facts About Home Loan LenderFascination About Clark Finance Group Mortgage Broker

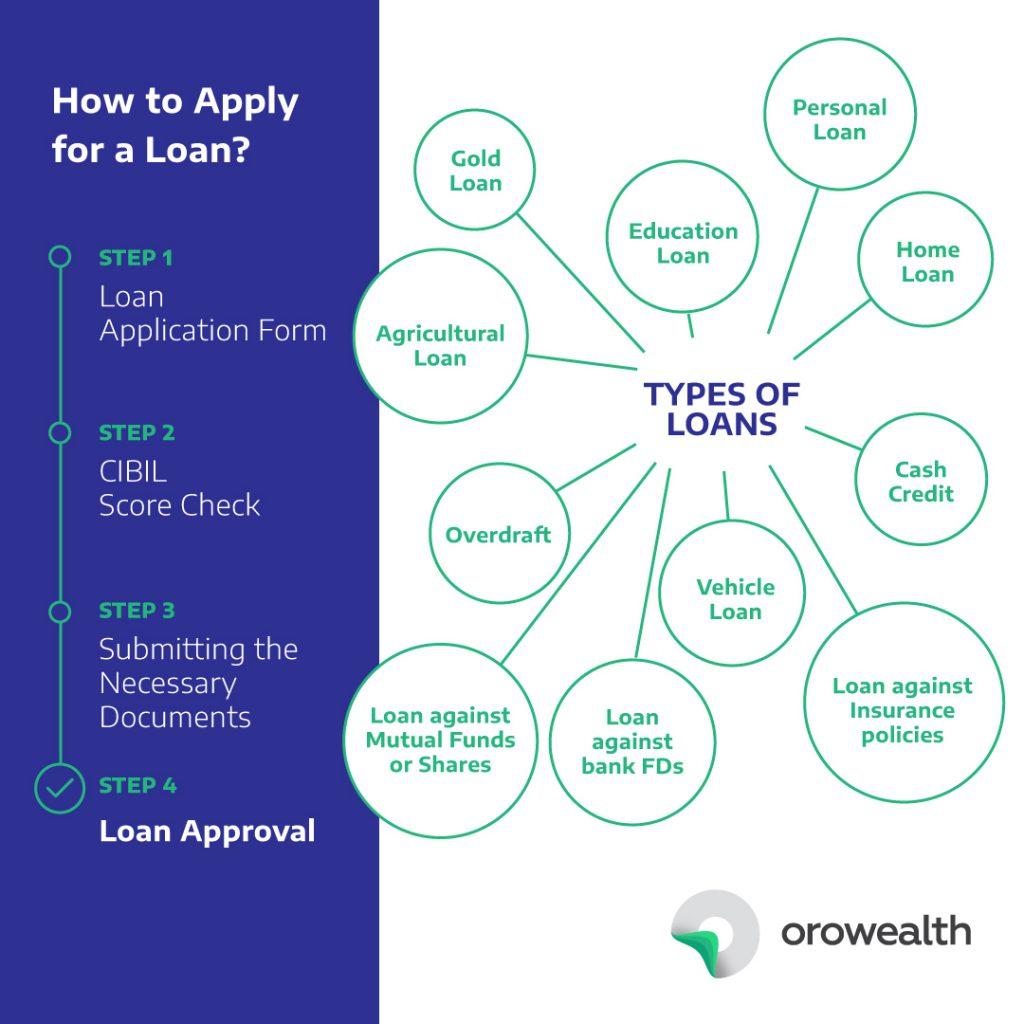

Sorts of Financings, Individual loans - You can get these lendings at almost any kind of bank. The bright side is that you can normally spend the cash however you such as. You may go on holiday, purchase a jet ski or obtain a brand-new television. Individual fundings are typically unsecured as well as fairly very easy to get if you have average credit report.These financings are secured by the residence or residential property you are buying. That indicates if you do not make your repayments in a prompt fashion, the bank or loan provider can take your residence or home back! Home mortgages help people obtain right into homes that would or else take years to conserve for. They are typically structured in 10-, 15- or 30-year terms, and also the rate of interest you pay is tax-deductible and fairly reduced compared to various other financings.

The equity or financing quantity would certainly be the difference between the evaluated worth of your residence and also the amount you still owe on your mortgage. These fundings are excellent for home additions, residence renovations or financial debt combination. The rates of interest is frequently tax insurance deductible and additionally fairly low compared to various other loans.

They do call for a bit more work than normal and frequently require a business strategy to show the validity of what you are doing. These are often secured loans, so you will certainly have to pledge some individual possessions as collateral in instance business stops working. Advantages of Lendings, Organization development and development - Finances are an excellent method for a business to increase as well as expand quicker than it otherwise could.

The smart Trick of Clark Finance Group Mortgage Broker That Nobody is Talking About

Passion - Paying simply the passion on numerous loans can end up setting you back people 10s of hundreds of bucks a year. One car loan might be workable, however add a home car loan, two automobile fundings, trainee fundings as well as a few charge card breakthroughs right into the mix, as well as the interest can get out of control really swiftly.

You do it a lot of times, as well as the bank or loan provider can legally repossess your home that you have been paying on for 10 years! Lesson Summary, A car loan is when you get money from a pal, financial institution or banks for future repayment of the principal and interest.

Clark Finance Group Refinance Home Loan Can Be Fun For Anyone

Personal fundings give you fast, flexible accessibility to funds that can be made use of for many major life events, m&t bank mortgage costs or combining financial debt, all with one fixed monthly payment. Combine charge card financial debt Streamline your month-to-month bills by consolidating your high interest financial obligation Refurbish your residence Update your living room without utilizing your home as collateral Purchase or repair an automobile Purchase the very best finance price and also acquisition or repair your auto anywhere Take a trip Money your whole trip or use it for spending money Fund your wedding Spread the cost of your wedding day over months or years Cover medical expenditures Cover unanticipated bills or intended therapies.

You after that repay the quantity gradually. You'll possibly additionally pay a certain amount of interest. Rate of interest is a charge you pay to borrow the cash. It's generally a portion of the finance added top of what you already owe. 1 When it comes to exactly how much interest you'll pay, there are various rates of interest for various kinds of fundings.

The complicated part of looking for a finance comes when you start browsing for kinds of consumer financings. As you learn concerning fundings, obtaining to understand vital expressions and terms can assist you locate the best kind for you.

Types of bank loan Conventional or term fundings A term financing, which is also described as a conventional lending, is funding borrowed from a financial institution that has to be settled over a set time period. This could be either a short or extended period, ranging from a couple construction loan rates of months to several years.

Getting The Clark Finance Group To Work

SBA financings The Small Service Administration (SBA) funds numerous car loans that are guaranteed by the federal government - Home Loan Lender. One of the most common sort of SBA loan is the SBA 7(a) loan. It has an optimum limit of $5 million and also is typically made use of to buy property, in addition to for functioning resources as well as financial debt refinancing.

SBA microloans are expanded approximately $5,000 with the purpose to aid tiny organizations expand and also spend in their operating funding, stock, as well as equipment. Equipment financing lendings An equipment funding finance is one that permits proprietors to buy devices as well as machinery for their operations. Businesses can use a lending toward office devices as well as devices for staff members or to make products.

Unlike other finances, companies will certainly need to make a down settlement before getting the car loan. The most usual type of SBA finance is the SBA 7(a) funding.